Investors Turn to Cryptocurrency as Silicon Valley Bank and Signature Bank Collapse

The collapse of Silicon Valley Bank (SVB) on Friday, March 10 sent shock-waves throughout the financial industry.

Two days previously, the bank had announced an after-tax loss of $1.8 billion and desperately required additional capital to allay the fears of its customers. However, the market reacted brutally, leading to SVB losing around $160 billion in value in 24 hours in the second-biggest banking collapse in history.

The sudden calamity spelled doom for Signature Bank, because its customers reacted to the SVB collapse by withdrawing over $10 billion in deposits. The result was the third-largest bank failure in American history.

Why Did Both Banks Collapse?

SVB was among the top 20 banks in the United States, with approximately $209 billion in assets and over $175 billion in deposits before its collapse. It transpired that the bank had invested its funds in long-term bonds when interest rates were near zero. However, once interest rates rose, the prices of long-term bonds fell drastically, resulting in a huge loss.

As SVB’s stock price crashed, its customers panicked and began withdrawing money en masse. Banks only have a certain percentage of depositor money available in what is known as a fractional reserve. Since SVB’s money was held in its failing long-term investments, it could not meet its customers’ withdrawal demands.

This issue caused the Federal Deposit Insurance Corporation (FDIC) to step in to ensure customers got their money. It is also worth noting that Greg Becket, the SVB CEO, withdrew around $3.6 million of company stock around a fortnight before the bank disclosed its heavy losses. Also, news broke that Peter Thiel’s Founders Fund venture capital firm had asked its companies to move their funds on March 9, which probably hastened SVB’s demise.

Unfortunately for Signature, customers reacted by withdrawing huge sums of money, resulting in the bank’s collapse.

SVB was an important bank for venture capital funds and start-ups worldwide. It specialized in the technology industry, offering funds to organizations classified as too risky for conventional lenders, such as cryptocurrency companies. The current situation therefore now points to more bad news for tech and crypto start-ups facing grave financial challenges.

Signature was always likely to suffer from SVB’s collapse because it was also a crypto-friendly bank. Therefore, it was only natural that its customers would react to the SVB news by trying to withdraw their cash.

How Did the Crypto Market React?

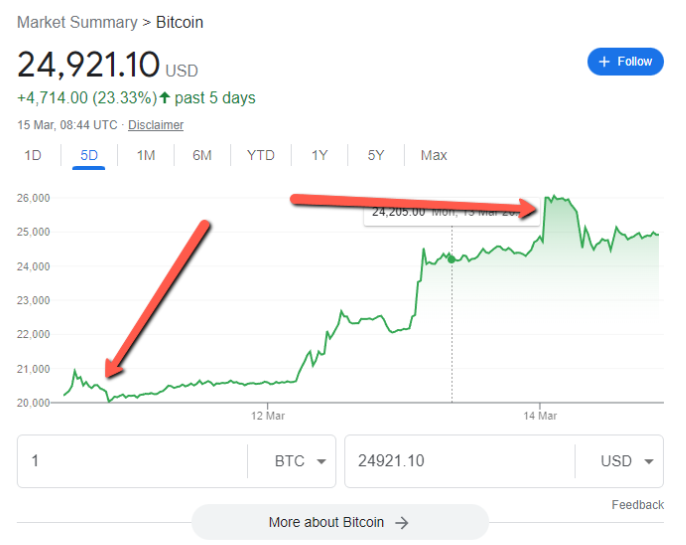

Initially, the cryptocurrency market’s value fell once the collapse of SVB and Signature became known. Bitcoin’s value fell from around $21,700 on March 8 to about $20,200 on March 10 when SVB officially collapsed.

However, the digital currency market rebounded within days. BTC’s value reached almost $26,000 by March 14.

Indeed, the cryptocurrency industry as a whole actually enjoyed a boost, as the stock price of traditional banks fell rapidly. Over a dozen regional banks had their trading halted on Monday, March 13, as their stock values plummeted.

For example, the value of S&P 500 Regional Banks (SPLRCBNKS) stock fell from over $113 on March 9 to under $80 on March 14.

The FDIC’s intervention was necessary to avoid a financial system capitulation. The fallout was such that President Biden addressed taxpayer concerns by saying, “Americans can have confidence that the banking system is safe.”

Yet the sudden collapse of two banks worth hundreds of billions of dollars is another example of how tenuous the existing financial system is. The fact that depositors needed the help of the FDIC to access their money is highly concerning. It also explains why some investors decided to put money into cryptocurrency.

When the conventional financial system fails, cryptocurrency is often the first port of call for panicked investors. Recent history suggests that other banks will ultimately join SVB and Signature on the scrap heap, only emphasizing the need to invest at least some capital in digital currency.